latest

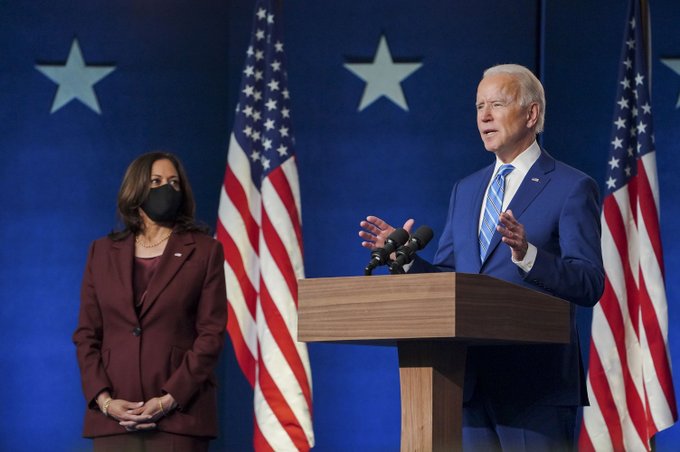

White House plans to issue up to $300 a month tax credit for years and years to come

Families in the United States could be seeing monthly tax payments for years to come.

According to the White House, the Child Tax Credit in the American Rescue Plan will provide the largest Child Tax Credit that has ever taken place in the country. Most families will automatically receive monthly payments without having to take any action.

For those with children, the American Rescue Plan increased the Child Tax Credit from $2,000 per child to $3,000 per child for children over the age of six and from $2,000 to $3,600 for children under the age of six, and raised the age limit from 16 to 17. All working families will get the full credit if they make up to $150,000 for a couple or $112,500 for a family with a single parent (also called Head of Household). If you are above those income levels, the extra amount past the $2,000 credit, $1,000 per child over the age of six or $1,600 per child under the age of six, is reduced by $50 for each extra $1,000 in modified Adjusted Gross Income.

People who receive payments by direct deposit will get their first payment on July 15, 2021. After that, payments will go out on the 15th of every month. (In August the payment will go out on August 13th since the 15th falls on a weekend.) If you haven’t provided the IRS with your bank account information on a recent tax return, a check will be sent out to you around the same time to the address the IRS has for you.

The new Child Tax Credit enacted in the American Rescue Plan is only for 2021. However, President Biden is looking to extend the new Child Tax Credit for years and years to come through his American Families Plan.

-

Community6 years ago

Community6 years agoNational Shrine of La Salette Festival of Lights 2017 set to begin

-

Community6 years ago

Community6 years agoMassachusetts State Police looking for good home for retired dogs

-

Crime6 years ago

Crime6 years agoFall River ranked most dangerous city in Massachusetts according to report

-

latest6 years ago

latest6 years agoDurfee student allegedly overdoses on marijuana

-

Community6 years ago

Community6 years agoVideo of Fall River Police goes viral

-

Causes6 years ago

Causes6 years agoMissing Fall River woman found deceased

-

Crime6 years ago

Crime6 years agoFall River Police add names to most wanted list

-

Causes6 years ago

Causes6 years agoFall River teenager reported missing has been found