latest

Massachusetts tax refunds will start to flow next week to 3 million taxpayers

Chris Lisinski

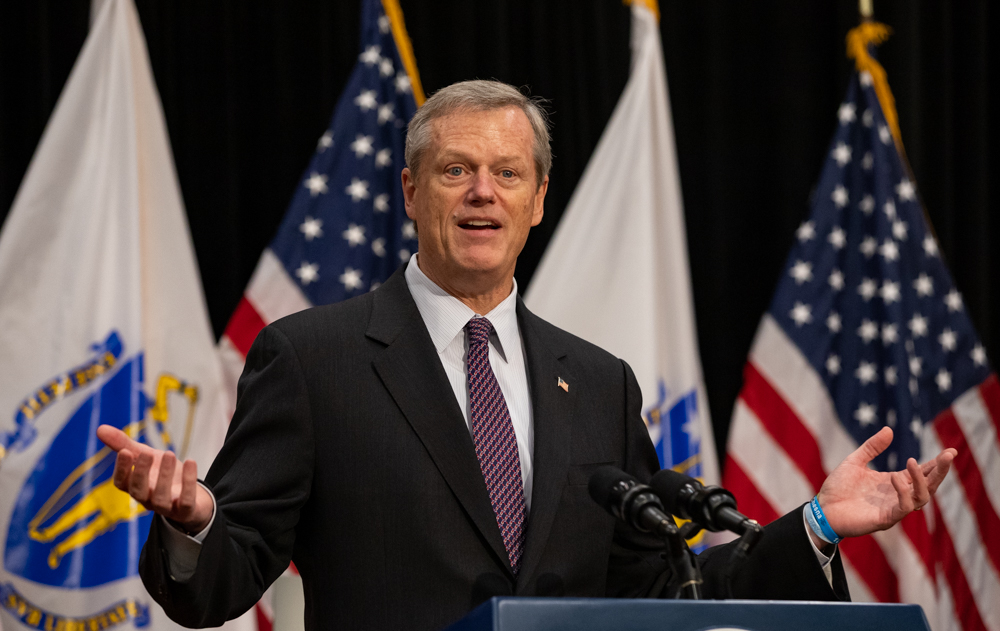

The first checks and direct deposits from a nearly $3 billion pot of excess tax revenue will head back to taxpayers starting on Tuesday when the calendar flips to November, the Baker administration announced Friday.

A spokesperson for the Executive Office of Administration and Finance said money will head out the door under the voter-approved tax cap law known as Chapter 62F, which taxpayers triggered for the first time since 1987 by delivering massive amounts of taxes. About 3 million taxpayers will receive a refund in the form of a mailed check or a direct deposit worth about 14 percent of what they owed in state personal income tax in 2021, the spokesperson said.

The administration plans to distribute the refunds on a rolling basis through Dec. 15. The administration had previously estimated refunds of about 13 percent of income tax liabilities.

Taxpayers who owed state personal income tax last year and already filed their 2021 return are eligible and do not need to take any additional steps to receive their refunds.

The administration published a frequently asked questions page online with a calculator that taxpayers can use to estimate their forthcoming refunds.

Erin Wolcott

October 29, 2022 at 9:55 am

This will not go to those in the Commonwealth who need this money – WHY? Because every resident who received Unemployment from the Commonwealth is now being told they did not qualify for these monies and now want these monies back. Even though your account was stopped until you provided information – medical – that you could not work. So, if you owe DUA after their employees APPROVED YOUR CLAIM – THE COMMONWEALTH IS GOING TO JUST TAKE THIS MONEY BACK SO YOU GET SCREWED ONCE AGAIN BY YOUR STATE GOVERNMENT! SO, SENIORS GET SCREWED BY OUR GOERNMENT ONCE AGAIN JUST LIKE ALWAYS!

Obvi ously

October 29, 2022 at 12:59 pm

Need has nothing to do with it.

If you paid taxes you will get a refund that is a portion of what you paid. If you paid no tax there is nothing to refund. It’s that simple. There are other programs in place for those in need. If there are states with tax refund programs that you think are fair, perhaps you would like to move there?

Dave P.

October 29, 2022 at 10:40 am

Why, if the “excess” tax revenue pot is actually $5.5 Billion, are the taxpayers only getting $2.9 Billion returned to them? Whose pockets are we lining with the missing $2.6 Billiion???

Obvi ously

October 29, 2022 at 1:03 pm

The state is allowed to hold funds for use in the future.