latest

Massachusetts jobless benefit questions now hang over tax relief debate

By Alison Kuznitz

STATE HOUSE, BOSTON, JUNE 5, 2023…..Top lawmakers are scrambling to figure out how much money, if any, the state might be on the hook for after auditors learned that the Baker administration erroneously spent $2.5 billion in federal funds on jobless benefits that should have been covered by state money during the COVID-19 pandemic.

It’s too early to speculate whether the misuse of the $2.5 billion could impact the Senate’s pending tax relief, Senate President Karen Spilka told reporters Monday afternoon, hours after her chamber’s budget chief told the News Service that tax break proposals would emerge within the next two weeks.

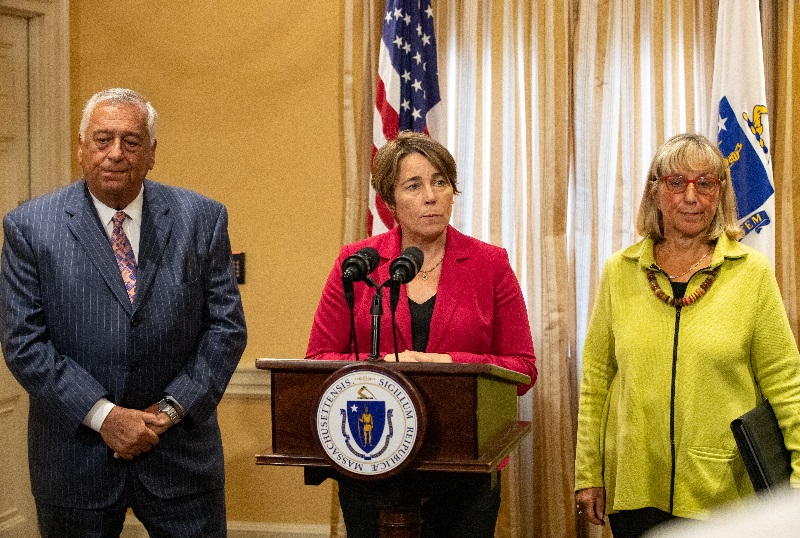

“We’re in the fact-finding stage right now, trying to figure out what happened and then what we may owe or not owe,” Spilka said at a press conference following a meeting with House Speaker Ron Mariano, Gov. Maura Healey and Lt. Gov. Kim Driscoll.

Mariano said officials “don’t even know how much they owe” but gave voice to the possibility there may be a “bill” down the road.

Last summer, legislative leaders were blindsided by the discovery that the state would be on the hook for nearly $3 billion in mandatory tax relief, upending their plans to pass targeted tax relief proposals, which are still actively circulating on Beacon Hill.

Beginning in 2020 and into the pandemic, the state mistakenly pulled from a federal allocation of money, rather than state coffers in the Unemployment Insurance Trust Fund. Healey said officials only became aware of the matter “very, very recently” due to an audit from an outside firm, despite “multiple” previous audits that failed to catch the error.

The goal is to reach a resolution that “minimizes any impacts to the commonwealth,” Healey said. Lawmakers made no mention of needing to dip into the state’s rainy day fund or impose new fees onto the business community to handle any financial pressure.

“Our way that we’re proceeding is to continue to discuss this matter with the U.S. Department of Labor,” Healey said, explaining that agency maintains the oversight arm. “There were multiple funds set up during this COVID pandemic time, and for whatever reason, money was drawn from a federal pot instead of a state pot, and we ended up with this deficiency.”

Healey also said that at some point, the federal and state accounts became “merged,” which caused the federal dollars to be “inadvertently drawn down.” The money, however, did go to “legitimate, deserving claimants,” Healey said.

The governor chalked up the confusion to “multiple” unemployment payment programs with “multiple” requirements — and changing requirements — happening simultaneously. Other states experienced “similar complications,” Healey said without offering specific examples.

“That’s a discussion between us and other states and the U.S. Department of Labor. I want to work to make sure that we are as protected as much as possible,” Healey said. “I am confident that the right steps have been taken to make sure that won’t happen again.”

It’s unclear how the federal dollars were supposed to be used, instead of footing jobless benefits. Healey said “no” Monday when asked whether there was something that went unfunded because the federal funds were diverted to cover jobless benefits.

In 2020, the state Division of Unemployment Assistance paid over $21 billion in benefits to almost 2.25 million claimants, and in 2021 it paid nearly $12 billion in benefits to over 1.7 million claimants, totaling over $33 billion in benefits paid during 2020-2021. In comparison, DUA paid out about $1.4 billion in benefits to 400,000 claimants in 2019.

The Senate is proceeding with its long-awaited tax relief plan. The Ashland Democrat wouldn’t comment on how May’s state tax revenue numbers — which were 6.7 percent above the most recent monthly benchmark, following an April nosedive — might influence tax relief, saying lawmakers are reviewing the report that came out earlier Monday.

“As I’ve said for many months, we will do a tax relief package, and it will be out soon. So stay tuned,” Spilka said.

The Senate last month approved its nearly $56 billion fiscal 2024 budget, which earmarked $575 million for to-be-determined tax breaks. The House in April approved a tax relief bill, with an estimated $587 million impact in fiscal 2024 in April.

Senate Ways and Means Chairman Michael Rodrigues, asked whether the unexpected $2.5 billion misuse of federal dollars gave him any concern, told the News Service “no” earlier Monday. Rodrigues, like Spilka, said the Senate is trying to gather facts about the situation.

“I only know what I read in the paper … We have conflicting audit reports,” Rodrigues said, citing reports from KPMG and CliftonLarsonAllen. “We have to just let the dust settle and the smoke clear to see what is true and then determine where all our various options are.”

Fed Up

June 5, 2023 at 8:32 pm

” 4. Massachusetts

Massachusetts has the fourth-highest debt in the United States. Massachusetts’s total liabilities are $104.53 billion, and its total assets are $34.214 billion, creating a debt of $68.43 billion. Long-term liabilities are at 305.5% of total assets. Massachusetts’s largest sources of debt are infrastructure and pensions. ”

4th state deepest in debt! Please keep up the reckless spending we can get to that #1 spot. Clowns